Everyone is talking about inflation and possible wars.

We could be going through a major inflection point in history and not really feel it until it plays out. If you’re worried about long-term financial security and have been looking at avenues to grow your wealth – first take a deep breath to acknowledge it’s not a terrible problem to have.

Slow breath in, breathe out. 🙂

The expectations of Fed hiking interest rates weakens the value of the US dollar as a reserve currency. With this, the probability of wars (cold or otherwise), makes increasing gold reserves a good proposition for central banks across the world.

Every year the world incrementally mines about 1% of the existing reserves of mined gold. Out of this, 50% is consumed in industrial applications and jewellery. The balance gets added to the global reserve in form of bullion. So, the theoretical value of gold would decline by about 0.50% every year in a world with no inflation. But then inflation is inching up. Here are the recent inflation numbers from the US:

And here are the US Inflation numbers for the last 25 years:

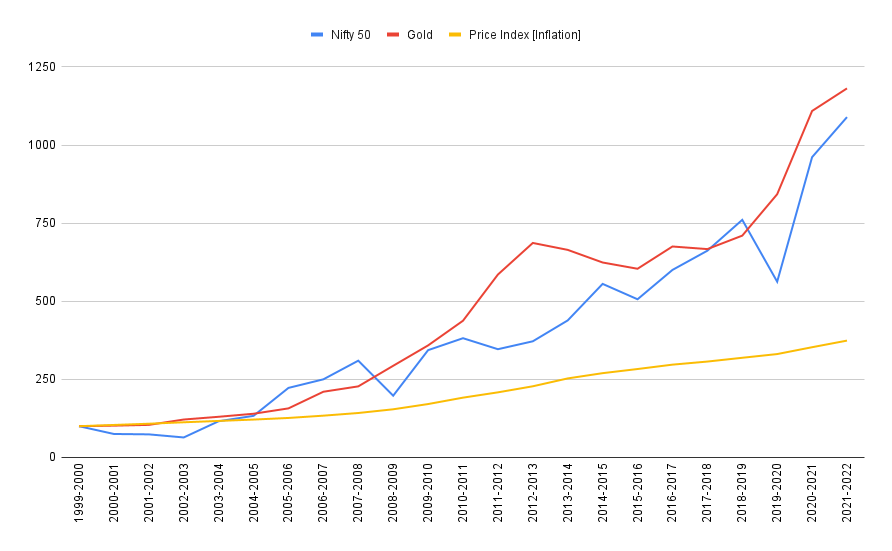

Gold is a great bet against inflation – almost at par with equity investments.

In the last 20 years, Gold has given similar returns when compared to Nifty 50. Both equities (Nifty 50) and gold have beaten inflation in the same period.

It is reasonable to have a permanent allocation in gold. If you already have gold in your portfolio, you can even increase your allocation until the concerns around inflation and wars dissipate.

What is the best way to invest in gold?

If you invest in Sovereign Gold Bonds (SGBs), you get 2.50% p.a. interest from RBI on the value of your investment until the SGBs mature. The value of SGBs is credited directly to your bank account when they mature after 8 years from the date of issue. The gains made on holding gold for this period are exempt from taxes.

Even if the equity markets do as well as they’ve done in the past 20 years, SGBs might even return better than the equity asset class.

Read this post to know what sort of baseline you might want in each asset class.